The Power of Alternative Data

By Ioana Nobel

Alternative data is much talked about in the investment community, but it is not necessarily easy to define. The boundary between alternative and mainstream data is blurred and moving as datasets become more easily accessible.

A subset of Big Data, alternative data is a way to measure a company’s performance that does not rely solely on internally generated information (such as company reports, earnings calls and financial statements) or collected from public sources (such as Government statistics). Examples of these non-traditional, non-financial and externally originating data sets include: credit & debit card transactions; satellite & weather imagery, social media consumer sentiment & behaviour or internet traffic data. So far, alternative data has been mainly the preserve of the hedge funds, but it can be used by a range of players to make informed business decisions, to differentiate their strategies and boost their returns:

- Hedge funds were the early adopters of alternative data and remain its main user group. Both fundamental and quantitative hedge funds use alternative data in their quest for alpha. Various surveys published over the past decade showcase the increased adoption of alternative data as a way to generate outperformance and identify investment opportunities.

- Private equity firms were later adopters, but those that do, recognise its value and use cases throughout the investment lifecycle: to originate deals, due diligence the performance of a target company vs its key competitors and optimise portfolio company performance.

- Corporates can use satellite imagery to monitor their sustainability practices or to manage their supply chains, a particularly topical concern in the face of recent events such as the Covid-19 pandemic and conflict in Ukraine. They can also assess their share of wallet of consumers’ spend in the particular product categories they operate in.

Surveys undertaken with the investment community in recent years indicate that the most used types of alternative data are:

- Web scraping data: using software programmes to collect data from Internet pages in order to extract pricing information; contact information for lead generation; brand mentions to monitor brand performance; key words and trends to optimise the website.

- Credit card transaction data: insights into consumer spending patterns and can be used to analyse the performance of a company's products or services.

- Social media data: insight into a company's brand perception, customer sentiment, and market trends from postings on social media platforms such as Twitter, Instagram and Facebook.

- Web traffic data: help to understand the performance of a website and identify trends and patterns in how people are using it for example number of people visiting a website, how they arrive to the website and the conversion rates from visits to purchase.

- Geolocation data: information on the location and movement of individuals or assets collected from GPS devices or mobile phones, which can be useful in a variety of contexts, such as analysing real estate investments or tracking the movement of goods.

- Satellite imagery: This data can be used to monitor over time a wide range of activities from agriculture to construction and transport and helps to provide information on a company's physical assets, such as stores, warehouses, or manufacturing facilities.

- Email receipts: receipts for online purchases and subscriptions are automatically sent by the merchant at the time of purchase. Alongside credit & debit card transactions, they represent a way to analyse consumer behaviour, assess the performance of a particular merchant and predict future demand.

Market Map

The alternative data environment is fragmented and expanding quickly. While many data buyers engage directly with potential providers, there has been an explosion of vendors making it time consuming to assess data vendors. When undertaking a high-level review of the alternative data space, Luminii Consulting noticed that there is considerable secrecy around the sources of data that some data vendors use. The proliferation of data vendors and the secrecy surrounding their sources increases the risk of dealing with rogue data providers or dubious methods of collecting the data.

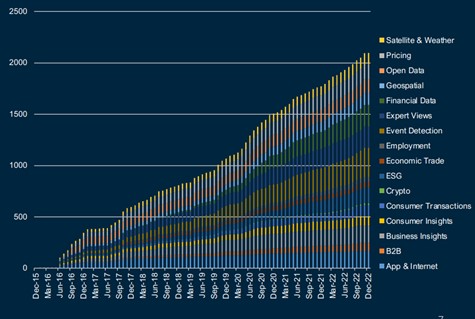

Therefore, some data buyers work with third-party providers who specialise in gathering and analysing this type of information as well as undertaking compliance due diligence of these providers. As such, a variety of channels to market (data brokers, data aggregators and analytical platforms) co-exist today. In terms of product categories, the taxonomy has developed over time in academic papers, UN reports, investment banking papers (such as the widely quoted 2017 and 2019 JP Morgan editions). In its latest annual market review, Eagle Alpha, an alternative data marketplace, categorises data vendors in 16 categories which are then further split into 56 sub-categories. As of December 2022, they profiled over to 1,750 datasets related to 2,100 main data categories (as one data set can include multiple categories).

Volume of Alternative Data Vendors and Data Sets

(Source: Eagle Alpha)

M&A and Private Equity Investments

Given the extreme industry fragmentation, corporate acquisitions have picked up pace in recent years and should come as no surprise. Acquisitions are driven by the desire to expand existing capabilities or gain access to unique data sets. Some of the companies in this space (be their targets or acquirers) were originally backed by PE investors, pointing towards clear trade exit routes for private equity firms considering investments in this space. A selection of the most notable transactions in recent years is included in the table.

Key Risks

Alternative data has the potential to provide valuable insights, nevertheless, it is important to acknowledge the drawbacks and risks associated. Such data is expensive and to make effective use of it requires specialist skills to interpret, hence between the cost if the subscription and hiring a team of data scientists to extract meaningful information, it can be a costly investment. Moreover, not all alternative data sources are created equal. Some sources may be more reliable or have more complete coverage than others. Some types of alternative data, such as geolocation data or consumer transaction data may raise data privacy and ethics concerns. It is important to ensure that any data being used is obtained and used in a legal and ethical manner as exemplified by some well publicised cases:

- Google Street View: In 2010, reports came out that while driving to collect images for Google’s Street View feature the vehicles had been collecting data from unsecured WiFi networks, including personal data such as emails and passwords.

- Cambridge Analytica: political consulting firm Cambridge Analytica had obtained the personal data of millions of Facebook users without their knowledge or consent and used it to create targeted political advertising during the 2016 U.S. presidential election.

- More recently, the Federal Trade Commission investigated Envestnet, and a privacy lawsuit was brought against Envestnet which operates Yodelee. Yodlee, a financial data aggregator, was alleged to collect and then sell access to anonymised financial data without meaningful notice to consumers, and store or transmits such data without adequate security, all in violation of California and federal privacy laws.

Conclusion

Despite the challenges described, alternative data adoption is likely to increase across the financial investment community as well in the corporate world to inform business strategy. As the Economist already declared in an article, “as the pile of information available grows, so too will [alternative data] adoption. At some point, there will be no alternative.” The prospect of a large total addressable market makes the alternative data segment ripe for private equity investment.

Sources

- 2022 Alternative Data Report: Year in Review by EagleAlpha

- The Book of Alternative Data by Alexander Denev and Seed Amen, Wiley (2020)

- 2019 Alternative Data Handbook, JP Morgan

- Why Investors Want Alternative Data, The Economist, 23 Aug 2016

- www.alternativedata.org

Latest articles

- Luminii provides Vendor Commercial Due Diligence to Osprey Flight Solutions 08 Sep 2025

- Luminii provides CDD support to Agathos on their investment in Enfuse Group 24 Jun 2025

- Luminii provides CDD support to BGF on their investment in PMC 17 Jun 2025

- Luminii provides CDD support to 57 Stars on their investment in New Life Teeth 28 Mar 2025

- Luminii provides CDD support to Maven on their investment in Blackdot Solutions 07 Feb 2025